There are many B2B invoicing software services out there, including QuickBooks Online, FreshBooks, Xero, Wave, and more. It can be hard to choose the right one, but you should go into the decision knowing what features are important to you.

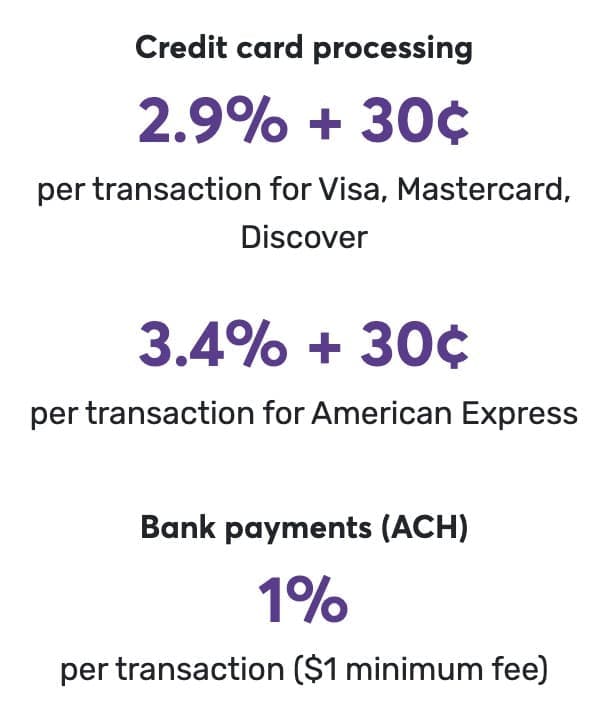

Features To Look ForFees, Fees, and More FeesIf you're collecting money online, you always need to factor in fees. These will quickly add up, whether it's bank fees, credit cards, payout fees, international fees, and fees that are charged by your invoicing software. While some options like Wave are free to use, most will have a monthly usage fee as well as per-transaction fees.

ACH vs. Credit Card FeesWhen you're shopping for your B2B invoicing software, pay close attention to the difference between ACH (bank debit) and credit card fees. For example, QuickBooks has a cap of $10 on ACH fees, but they have a relatively high monthly plan price. If your business primarily accepts credit card payments, it might not be worth it for you to pick QuickBooks purely for their cap on ACH fees.

If you use AloaPay, you get a $5 cap on ACH fees as well as the industry standard 2.9% + $0.30 per transaction on credit card payments. Since AloaPay uses Stripe Connect, the fees are among the lowest for online payments solutions.

AloaPay also helps lower your overall fees by naturally pushing customers away from using credit cards (higher fees) and using ACH instead (much lower fees). They do this by allowing your business to set your own fees, meaning you can manipulate your credit card and ACH fees in such a way that customers are naturally pushed to use ACH.

Most services like QuickBooks also don't allow you, the vendor, to specify who should cover the fees. The vendor always has to pay for fees, and some services also have an additional withdrawal or payout fee on top, so you could receive even less depending on how quickly you want your money. AloaPay addresses this pain point by allowing vendors to specify which party should cover the processing fees on payments. If you're mostly receiving credit card payments, this will quickly add up.

Keeping Track of InvoicesWe've heard and experienced the same pain point with QuickBooks over and over again. Customers have a really hard time keeping track of invoices, both pain and unpaid. QuickBooks invoices are sent to customers as emails, and there's no central dashboard for customers to keep track of them. Customers have to resort to searching through their inboxes to find that one pesky invoice you sent them weeks ago.

Why should vendors care about the customer experience? Well, if customers have a hard time finding unpaid and outstanding invoices, chances are you're getting paid later. If you want to reduce your accounts receivable and get paid faster, you need something better.

With platforms like AND.CO, Inly, and AloaPay, neither you nor your customers have to dig through emails to find invoices anymore. Both parties get a dashboard where outstanding bills can be paid and past and upcoming invoices can be viewed.

Although this may seem like a small feature, to us it's second only to minimizing your fees. Providing our clients with a central, easy to use place to pay and view invoices single-handedly reduced our collections time significantly, while also reducing the amount of times we had to remind clients to pay.

Automatic Recurring InvoicesIf your business is mostly one-off transactions, you probably don't need automatic recurring invoices. However, if you have a lot of monthly recurring business like many service companies do, automatic recurring invoices will improve your invoicing experience greatly.

QuickBooks, Wave, and many other invoicing software programs allow you to quickly and easily set automatic recurring invoices. The best thing about this feature is you don't have manually send out a new invoice each month to your recurring customers when their bill hardly changes month-to-month.

The best thing about an invoicing software like AloaPay that provides a dashboard for all invoices is clients can view their expected invoices for months in advance. This allows clients to know what invoices are coming up, and never be blindsided by a recurring invoice. It also allows recurring customers to pay for recurring invoices in advance, if they choose to.

Platforms like Wave and AloaPay take automatic recurring invoices one step further by allowing vendors to auto-bill their clients each month. If this option is selected, clients are automatically billed on their stored payment method when their recurring invoice is due, reducing accounts receivable and collections time.

Custom Email Reminder SequencingMany online invoicing services don't allow you to customize your email template or set a custom schedule for sending email reminders to customers. QuickBooks recently rolled this feature out, but we can't find it on our account nor can one of our clients who uses them, so it seems to be rather limited right now.

The benefit of being able to customize your email templates is you can personalize your reminder emails to be more in line with your overall brand. When customers receive your reminder emails, they can take one look and know it's from your company.

Custom email reminder sequencing is also important because different industries have different needs for how quickly they need payments, or what their "NET-D" terms are. If your business generally tries to get payments as soon as possible, you might want to make your email reminder schedule on a tighter schedule.

AloaPay let's you both customize your email templates and set a custom email reminder schedule for your customers. This way, customers will get emails that look like a part of your cohesive brand, while also ensuring customers get reminders when you want them to. If you have had any issues with getting customers to pay in the past, you should consider these features essential for your business.

Overview of B2B Invoicing SoftwareWe hope our overview of important features in B2B invoicing software was helpful for your decision. Depending on your business' current account receivables and collections time, you might want to prioritize having an invoice dashboard and custom email reminder sequencing. If you have a lot of customers that pay with credit card rather than ACH bank debit, you might prioritize the ability to choose which party covers the fees or the ability to customize your ACH and credit card fees.

Let us know if this was helpful in deciding which B2B invoicing software to use. If you have further questions or need more help making your decision, reach out to us via website chat or at resources@aloa.co!

---------------------------

This article was written by Aloa.

Do you have any software needs?

Get in touch with us here!